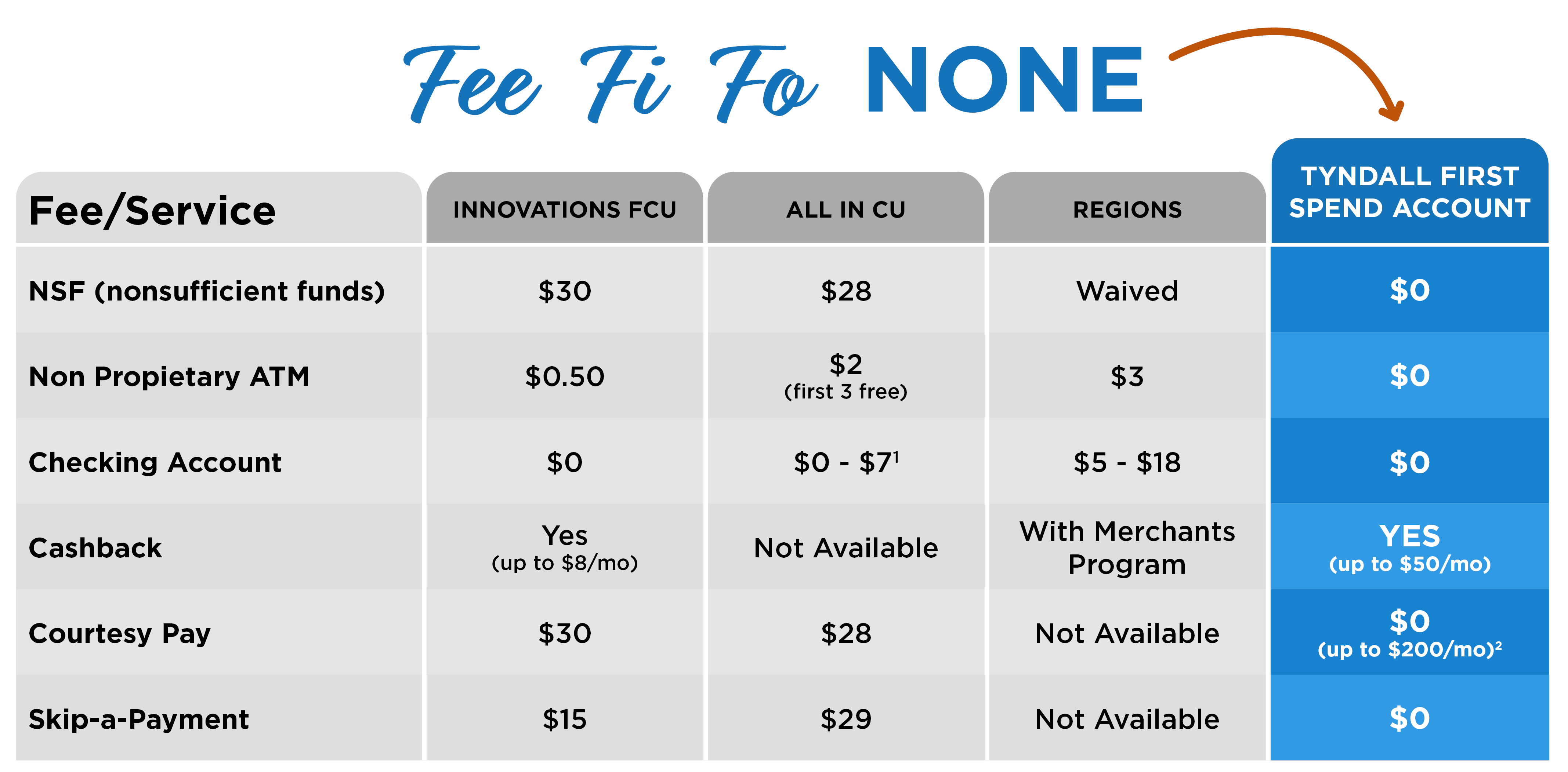

A Tyndall First account offers lower fees, cashback, and automatic round up savings.

According to a MoneyRates survey, the average monthly maintenance fee for a bank checking account is $12. That’s nearly $150 each year!

At Tyndall, our members are the owners, so we want to help you keep as much of your money as possible to grow your own net worth. That means removing nuisance fees everywhere we can, and for the few fees we charge, making sure they are clear and transparent.

We understand that mistakes happen; if you overdraw your Tyndall First Spend Account, we offer fee-free Courtesy Pay (up to $200) to ensure the transaction goes through. If you need to withdraw cash, you can use your card, surcharge-free, at over 55,000 Publix Presto! and Allpoint ATMs, worldwide. Another way we help you save is being able to skip your payment twice a year on eligible loans. This service is offered without fees, online, and year-round.

Federally insured by NCUA

Sourced as of February 23,2023. Fees are subject to change. ¹If less than $10,000. ²Applies to debit card swipes only (you must opt-in to authorize and pay overdrafts on ATM and everyday debit card transactions); after a $200.00 negative balance is reached our standard Courtesy Pay Fees will resume; you must have at least $500.00 deposited via ACH and/or Mobile Deposit each month to qualify. See our Rate & Fee Schedule for our Courtesy Pay fees. You must bring your account to a positive balance as soon as possible, within 30 days. Whether your overdrafts will be paid is discretionary and we reserve the right not to pay them. For example, we typically do not pay overdrafts if your account is not in good standing.