You're Pre-Qualified!

Borrow against the equity in your home

Travel, Renovate, or Consolidate with a HELOC or Home Equity Loan

With a Home Equity Line of Credit (HELOC), you'll have a revolving line of credit that you can use for years. It’s like writing yourself a loan for whatever you need, whenever you need it. A flexible HELOC is a loan you can access only when you need to—and you only pay interest and principal on the amount you use. It is convenient to transfer funds directly from your HELOC account to you checking account and have your funds available instantly.

A Home Equity Loan offers you a high borrowing limit (up to 80% of your home’s value), competitive rate, no closing costs* and low monthly payments with terms up to 20 years. With a Tyndall Home Equity Loan you can make home improvements, fund your next adventure, consolidate debt, add a swimming pool, or cover large purchases with a competitive fixed rate that your monthly payment won’t change!

-

Fast

-

Competitive interest rate

-

Flexible

Request More Information for Home Equity Line of Credit or Home Equity Loan.

Please do not include any account information when submitting this form.

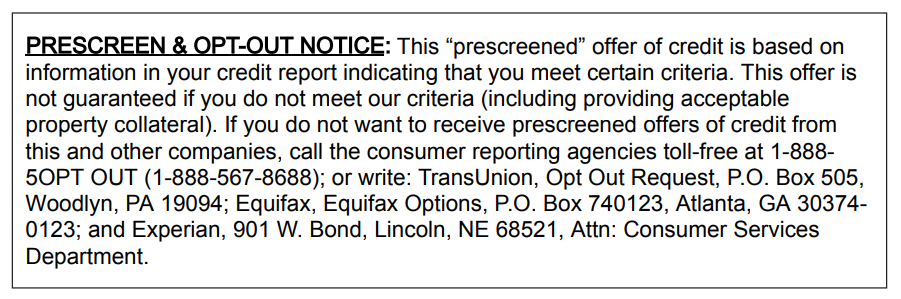

*APR = Annual Percentage Rate. This offer is valid for the individual to whom this mail is addressed from June 15, 2025 to August 31, 2025 and is only applicable to a Tyndall Home Equity or HELOC. Loan approval contingent upon verification of sufficient income. You received this offer because you met certain criteria for creditworthiness. We may not extend credit to you if, after receiving your application, we find that you do not continue to meet the criteria used to select you, or if we find that your income is not sufficient to meet Tyndall’s guidelines. Subject to completed application and approval. Must pass a home inspection to qualify. Product not available in Texas, Alaska, Hawaii, Connecticut, New York, or California. Home Equity: Rates shown are generally the lowest currently available. Subject to loan approval and closing. Borrower is responsible for property insurance and flood insurance, if applicable, and property taxes. The loan’s property must be insured until the loan is paid in full. Subject property must be your primary or secondary residence. After your application has been completed and approved, a closing date will be scheduled. Rates and maximum Loan-to-Value are based on the borrower’s creditworthiness. A mortgage loan of $45,000 for 10 years at 6.000% APR will have a monthly payment of $499.59. Taxes and insurance not included, your actual payment obligation will be higher. “No Closing Costs” Promotional offer - for a Home Equity Loan, Tyndall will pay all typical closing costs on primary residences. Typical closing costs do not include an appraisal, nor does it include a title policy and associated fees if the loan is required to close at the title company. To receive “No Closing Costs” offer, Minimum Loan Amount - HE Loan $7,500; Minimum Loan Amount - Equity Advantage $25,000; Maximum Loan Amount - $500,000. If loan is terminated within 3 years, closing costs that were paid by Tyndall must be reimbursed by the borrower. Promotional offers open to members who apply for and open a Home Equity Loan during the promotional period. Offer available for a limited time. HELOC: Subject to loan approval and closing. Borrower is responsible for property insurance and flood insurance, if applicable, and property taxes. Property securing the loan must be insured until the loan is paid in full. Subject property must be your primary or secondary residence. After your application has been completed and approved, a closing date will be scheduled. Rates and maximum Loan-to-Value are based on borrower’s creditworthiness. Home Equity Lines of Credit have a variable APR, with a minimum APR of 7.49% and maximum APR of 18%. Interest rate may change monthly. The Index used to determine your Variable APR is the Prime Rate (published in the Money Rates column of the Wall Street Journal on the last business day the rate is published in each calendar month). The Prime Rate is 7.50%, as of 12-19-24. Loan terms are 20 years: 10-year draw period; 10-year repayment period or 20 years: 5-year draw period; 15-year repayment period. Maximum LTV 80%. Minimum Loan Amount - $10,000; Maximum Loan Amount - $500,000; Minimum Initial Advance - $1,000. Closing Costs Offer: For a limited time, Tyndall will pay all typical closing costs on primary residence. This excludes appraisal and title insurance, if required. Please see a Tyndall representative for more details. Minimum draw of $10,000 required to receive promotional offer. If daily balance falls below $5,000 during any of the initial 12 months, or if the line is closed during the initial 36 months, closing costs paid by Tyndall will be charged to the borrower. Limited time offer. Some restrictions apply. Property securing the loan must be insured until the loan is paid in full. Membership required; NO membership fee applies. Checking Account required: Minimum opening deposit is $25; no minimum balance requirement. Tyndall NMLS #597599. Some restrictions apply. Rates and offer subject to change; based upon and variable with the Prime Rate published in the WSJ. LATE CHARGE - If your payment is more than 10 days late, we may collect a late payment charge from you of 10% of the payment then due, with a minimum of $5.00.