Tyndall Federal Credit Union was chartered in January of 1956 and was located in Building 207 at Tyndall Air Force Base to serve our members of the Air Force and Armed Forces. For the past 68 years, we have been dedicated to addressing the unique financial needs and challenges faced by military members.

Specialized Loans

If you are serving your first-term, you can take advantage of our First Term Military Loan Program that offers special auto, motorcycle, and credit card loans to active duty military members even if you have limited or no credit. A VA Home Loan is available to anyone who has served 90 days during wartime, 181 days during peacetime, 6 years national guard, or the spouse of a service member who died while in the line of duty.

Credit Building Opportunities

Whether you are interested in building, rebuilding, or maintaining good credit, it takes time. Establishing a good credit history early in your military career makes it easier for you to qualify for loans, credit cards, and other forms of credit. Tyndall offers a Credit Builder Loan, Secured Credit Card, and Account Secured Loans.

Financial Education

Financial literacy is important for any stage of military life. From enlistment and earning your first paycheck, to deployment, to transitioning to civilian life, financial literacy will prepare you to budget, manage debt, and invest for the future. Tyndall offers many Financial Literacy options that allow you to learn on your own time, speak with a team member, or even schedule a financial literacy class taught by Tyndall.

Investment and Retirement Planning

Retirement may be years away, but it is never too early to start planning. A Tyndall Individual Retirement Account is a safe way to invest; earning a flat interest rate means you’ll never lose money. We also offer Retirement and Investment Services through MEMBERS Financial Service Program. This is a personal financial management service designed exclusively of credit union members.

By offering our military members specialized financial services, loans, and financial literacy, we can provide peace of mind that your finances are safe while you are keeping our nation safe.

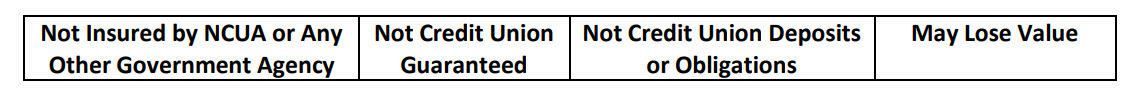

Securities and advisory services are offered through LPL Financial (LPL), a registered broker-dealer (member FINRA SIPC). Insurance products are offered through LPL or its licensed affiliates. Tyndall Federal Credit Union is not registered as broker-dealer or investment advisor. Registered representatives of LPL offer products and services using, and may also be employees of Tyndall Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Tyndall Federal Credit Union. Securities and insurance offered through LPL or its affiliates are: The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

To learn more about the background of your financial professional, please go to BrokerCheck by FINRA.

**Prior to requesting a rollover from your employer-sponsored retirement account to an Individual Retirement Account (IRA), you should consider whether the rollover is suitable for you. There may be important differences in features, costs, services, withdrawal options, and other important aspects between your employer-sponsored retirement account and an IRA.

FR-2203235.1-0818-0920

f1a2c04b-b58f-4d74-bff8-f9aa3feb2d22.jpg?sfvrsn=e18854b8_1)